The name says it all. ProShares Equities for Rising Rates ETF (EQRR) is an ETF built on a strategy specifically designed to seek relative outperformance over traditional U.S. large-cap indexes during periods of rising interest rates. EQRR’s index—Nasdaq U.S. Large Cap Equities for Rising Rates Index—has nearly doubled the return of the S&P 500 since the 10-Year U.S. Treasury’s lowest historical closing level in the summer of 2020.

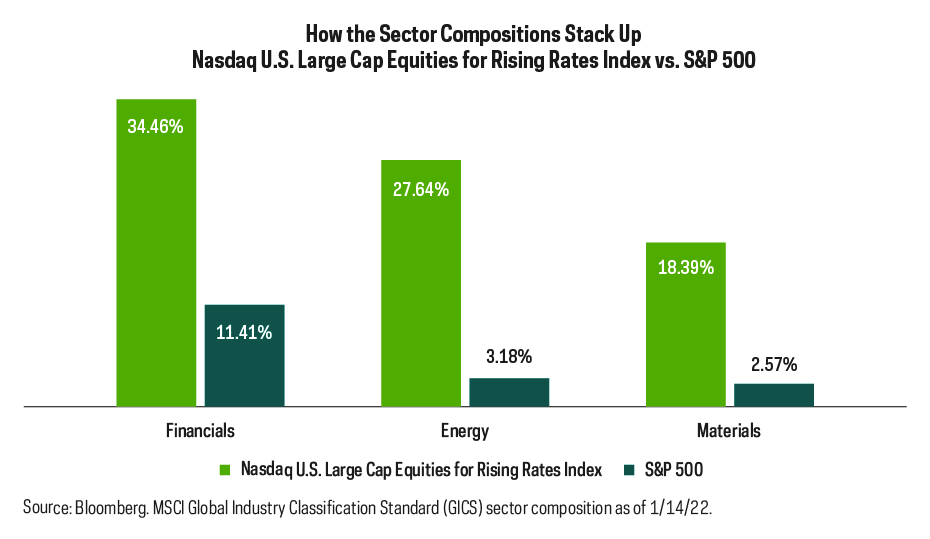

EQRR’s index targets sectors that have had the highest correlation to 10-Year U.S. Treasury yields, and within those sectors targets the stocks that have had a tendency to outperform as rates rise. Perhaps not surprisingly, financials have been at the top of the list as rising rates can lead to higher margins. In addition, energy and materials stocks both stand to benefit from the inflation that usually accompanies rising rates. As the graph that follows illustrates, EQRR’s index has a total allocation of more than 80% to the financials, energy and materials sectors, while the S&P 500’s allocation to these totals only 17%.

If interest rates continue to rise in 2022, now may be the time to explore strategies for your large-cap equities sleeve. ProShares Equities for Rising Rates ETF (EQRR) seeks investment results, before fees and expenses, that track the performance of the Nasdaq U.S. Large Cap Equities for Rising Rates Index. The goal of the fund is to provide relative outperformance, as compared to traditional U.S. large-cap indexes, such as the S&P 500, during periods of rising U.S. Treasury interest rates.

-

Built on a strategy that is specifically designed to seek relative outperformance over traditional U.S. large-cap indexes during periods of rising interest rates.

-

Targets sectors that have had the highest correlation to 10-Year U.S. Treasury yields and, within those sectors, the stocks that have had a strong tendency to generate relative outperformance as rates rise.

-

Can be used to complement traditional large-cap equity investments.

This information is not meant to be investment advice. There is no guarantee that the strategies discussed will be effective. Investment comparisons are for illustrative purposes only and not meant to be all-inclusive.

Any forward-looking statements herein are based on expectations of ProShare Advisors LLC at this time. ProShare Advisors LLC undertakes no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Investing is currently subject to additional risks and uncertainties related to COVID-19, including general economic, market and business conditions; changes in laws or regulations or other actions made by governmental authorities or regulatory bodies; and world economic and political developments.

Investing involves risk, including the possible loss of principal. This ProShares ETF is subject to certain risks, including the risk that the fund may not track the performance of the index and that the fund’s market price may fluctuate, which may decrease performance. Please see their summary and full prospectuses for a more complete description of risks. There is no guarantee any ProShares ETF will achieve its investment objective.

The fund is designed to provide relative outperformance, as compared to traditional U.S. large-cap indexes, such as the S&P 500, during periods of rising U.S. Treasury interest rates. As a result, the fund may be more susceptible to underperformance in a falling rate environment. There can be no guarantee that the fund will provide positive returns or outperform other indexes.

The fund concentrates its investments in certain sectors. Narrowly focused investments typically exhibit higher volatility.

Carefully consider the investment objectives, risks, charges and expenses of ProShares before investing. This and other information can be found in their summary and full prospectuses. Read them carefully before investing.

Nasdaq® is a registered trademark of Nasdaq, Inc. and is licensed for use by ProShare Advisors LLC. ProShares ETFs have not been passed on by Nasdaq, Inc. or its affiliates as to their legality or suitability. ProShares ETFs based on the Nasdaq U.S. Large Cap Equities for Rising Rates Index are not issued, sponsored, endorsed, sold, or promoted by Nasdaq, Inc. or its affiliates, and they make no representation regarding the advisability of investing in ProShares ETFs. THESE ENTITIES AND THEIR AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES.

ProShares are distributed by SEI Investments Distribution Co., which is not affiliated with the funds' advisor.

Learn More

EQRR

Equities for Rising Rates ETF

Seeks investment results, before fees and expenses, that track the performance of the Nasdaq U.S. Large Cap Equities for Rising Rates Index.

ANEW

MSCI Transformational Changes ETF

ProShares MSCI Transformational Changes ETF invests in companies which may benefit from transformational changes in how we work, take care of our health, and consume and connect—changes accelerated by COVID-19.

BITO

Bitcoin Strategy ETF

The fund invests in bitcoin futures and does not invest in spot bitcoin. There is no guarantee the fund will continue to closely track spot bitcoin.